Disregarded Entities: Characteristics & Key Tax Implications

For small business owners and solo entrepreneurs, selecting the right business structure can streamline operations and improve tax efficiency.

Disregarded entities offer a unique blend of simplicity and flexibility, making them an attractive option for many businesses. By understanding the characteristics and tax implications of these entities, you can make informed decisions about your business structure and optimize your tax strategy.

Main Takeaways From This Article:

- Disregarded entities are a type of business structure that offers a simple and flexible way to operate a business. They are characterized by a single owner and a unique tax treatment.

- One of the primary advantages of disregarded entities is their pass-through taxation system, which helps business owners avoid double taxation and simplify their tax filing.

- While sole proprietorships do not offer personal liability protection, single-member LLCs do. This means that the owner’s personal assets are shielded from business debts and liabilities.

- Disregarded entities require fewer formalities and compliance obligations than corporations, allowing business owners to focus on running their businesses.

- FileJet’s entity management software provides an effective solution for automating compliance and streamlining filings for disregarded entities.

What Is a Disregarded Entity?

A disregarded entity is a business structure with a single owner that the IRS disregards for federal income tax purposes. Legally distinct, it passes income, deductions, and credits onto the owner’s personal tax return. This structure offers simplicity and potential liability protection, empowering business owners to focus on growth and financial success.

Key Characteristics of Disregarded Entities

Disregarded entities have various characteristics that shape their operational and legal framework. Let’s explore these characteristics below.

Ownership Structure

Disregarded entities must be owned by a single individual or entity. This straightforward ownership structure allows for easy management and decision-making, as no complex partnership agreements exist. Here are the types of disregarded entities:

Single-Member LLCs

These limited liability companies (LLCs) have a single owner and are legally separate from that owner. However, for federal tax purposes, the IRS disregards them, passing all profits and losses directly to the owner’s personal tax return. This structure provides liability protection, shielding personal assets from business debts.

Sole Proprietorship

Sole proprietorships are the simplest form of business structure. They involve a single owner who operates the business in their own name. While they are easy to start and manage, they do not offer liability protection. Like single-member LLCs, sole proprietorships are disregarded for tax purposes, and their income and expenses flow through to the owner’s personal tax return.

Operational Flexibility

Single-member LLCs and sole proprietorships are known for offering operational flexibility. They require fewer formalities and compliance obligations compared to corporations. Business owners don’t have to comply with corporate governance requirements, freeing up time and resources to focus on growth and daily operations.

Pass-Through Reporting

A defining feature of disregarded entities is pass-through treatment, where the entity’s income, deductions, and losses flow directly to the owner. This setup allows for streamlined financial management. By eliminating separate business-level reporting, pass-through treatment minimizes the administrative burden on business owners and simplifies overall financial tracking.

Implications of Disregarded Entities for Tax Purposes

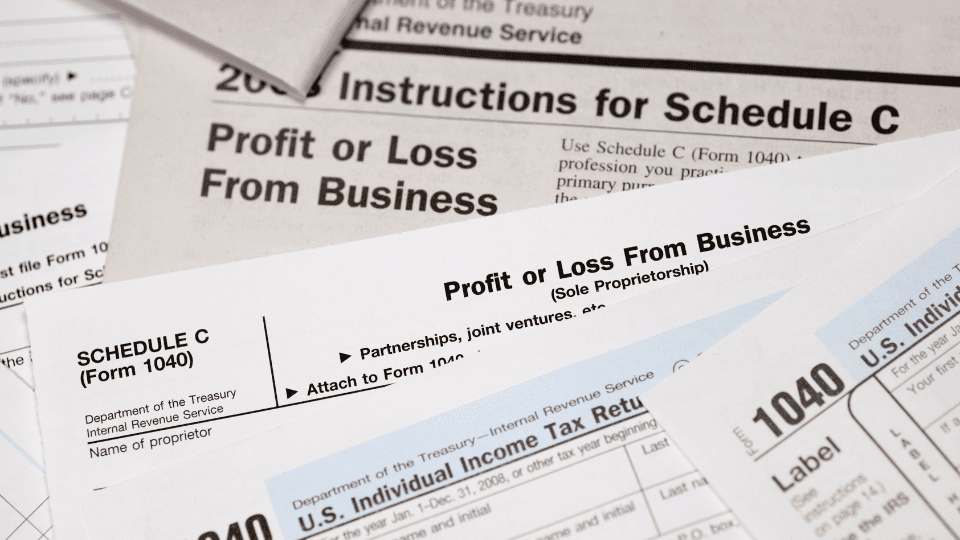

The IRS uses the term “disregarded entity” to describe a business structure that is not treated as a separate legal entity from its owner for federal tax purposes. This section clarifies the tax implications for disregarded entities, discussing the key aspects to streamline the preparation process for tax filings and obligations.

Pass-Through Taxation

While pass-through reporting minimizes administrative work, pass-through taxation enables disregarded entities to bypass federal entity-level taxes entirely. Under this structure, all business income, deductions, credits, and losses flow directly to the owner’s personal tax return, eliminating the need for a separate federal tax filing at the entity level.

This setup contrasts sharply with corporate double taxation, where profits are taxed both at the corporate and individual levels. In a disregarded entity, however, only the owner is taxed on the business’s net income for federal purposes. This direct application of business activity to the owner’s personal tax obligations makes pass-through taxation a straightforward and tax-efficient choice for single-owner businesses.

Self-Employment Tax Considerations

Beyond pass-through treatment, owners of disregarded entities should consider other potential tax obligations. For example, they may be subject to self-employment tax, which includes Social Security and Medicare taxes. This tax is typically higher than the employee portion of payroll taxes, as it covers both the employer and employee shares.

To avoid underpayment penalties, owners of disregarded entities may need to make quarterly estimated tax payments.

State and Local Taxes

State and local tax implications for disregarded entities can vary depending on the specific jurisdiction. Some states may treat disregarded entities as separate entities for state income tax purposes, while others may treat them as pass-through entities. It’s essential to consult with a tax professional to understand the specific tax implications in your state and local jurisdiction.

If the business engages in sales activities, it may be subject to sales tax. Sales tax rules can be complex and vary by state and locality.

Benefits of Choosing a Disregarded Entity Structure

As discussed above, the primary benefit of a disregarded entity is its pass-through tax treatment. However, opting for the disregarded entity structure offers other unique advantages for solopreneurs, such as:

Straightforward Administration

Disregarded entities require far less administrative work than corporations. With no need for board meetings, shareholder votes, or extensive record-keeping, owners save time and resources, avoiding the overhead costs typical of corporate structures.

Liability Protection

Single-member LLCs offer limited liability protection, shielding the owner’s personal assets from business debts or claims. However, it is important to note that this legal boundary does not apply to sole proprietorships, where personal and business liabilities are merged, exposing personal assets to creditors.

Risks and Limitations of Disregarded Entities

While disregarded entities offer advantages, it’s important to understand their downsides and limitations. These include the following:

Increased Personal Tax Liability

As the profits and losses of a disregarded entity flow through to the owner’s personal tax return, the owner is personally liable for all business taxes. This can increase the overall tax burden, especially in high-income years.

Limited Growth Scalability

Disregarded entities may not be the best choice for businesses with significant growth plans or the need to raise capital from external investors. A corporation’s limited liability protection and organizational structure may be more suitable for these types of businesses.

Compliance Risks Across Jurisdictions

In some states, disregarded entities may be subject to state and local taxes and regulations. These rules can be complex and change frequently. For businesses operating in multiple jurisdictions, keeping up with the myriad rules and filing requirements can be challenging.

Lack of Formality for Asset Protection

Sole proprietorships, a common type of disregarded entity, offer limited asset protection. This means that the owner’s personal assets may be at risk if the business faces lawsuits or financial difficulties. Single-member LLCs, on the other hand, offer limited liability protection.

Choosing the Right Business Entity: Is a Disregarded Entity the Best Option?

Generally, disregarded entities are a suitable option for small businesses with the following four characteristics:

- Single-Member Ownership: If a single individual or entity owns the business, a disregarded entity can be a simple and efficient structure.

- Limited Growth Ambitions: If the business does not have significant growth plans or the need to raise capital, a disregarded entity can be a cost-effective option.

- Tax Transparency: A disregarded entity can provide tax transparency if the owner prefers to have the business’s income and expenses reflected in their personal tax return.

- Limited Liability Protection: While disregarded entities offer limited liability protection, it’s important to consider the level of protection needed for your business. A corporation may provide more robust asset protection if your business faces significant risks or liabilities.

If your business has the following characteristics, a disregarded entity may not be the best option:

- Multiple Owners: If the business has multiple owners, a disregarded entity cannot be used.

- Big Growth Ambitions: If the business plans to raise capital, attract investors, or expand into new markets, a corporation or limited liability partnership (LLP) may be more suitable.

- Complex Ownership Structures: If the business has complex ownership structures, such as partnerships or trusts, a disregarded entity may not be the most efficient choice.

- Asset Protection Needs: If the business faces significant risks or liabilities, a corporation may provide more robust asset protection.

The best business entity for your needs will depend on your specific circumstances. It’s best to consult with a tax professional or attorney to evaluate the risks and benefits of opting for a disregarded entity and then decide if it will align with your goals and aspirations.

Streamline Your Entity Management With Filejet

Disregarded entities simplify tax and compliance, but managing filings can still be time-consuming. Filejet provides a comprehensive solution to automate these tasks, allowing you to focus on growing your business. Here’s how:

- Automated Compliance: The platform is designed to ensure you stay up-to-date with state and federal report filing requirements, reducing the risk of penalties and fines.

- Centralized Document Management: Keep all important business documents, filings, and financial information organized in one secure location.

- Customizable Reporting: Generate tailored reports to track your entity’s performance and identify areas for improvement.

- Streamlined Communication: Collaborating with your team, advisors, and regulators through Filejet’s secure communication platform makes decision-making easier.

Don’t let compliance complexities slow you down. Book a demo today to learn how our platform can transform your entity management experience!

FAQs

Does a Disregarded Entity Need an EIN?

Whether a disregarded entity needs an Employer Identification Number (EIN) often depends on its activities. Generally, the entity might not require an EIN if it is not responsible for employment or handling excise taxes. Obtaining an EIN can be necessary for certain banking purposes to align with federal employment tax requirements and address specific operational needs.

What Are the Pros and Cons of a Disregarded Entity?

Disregarded entities offer benefits such as pass-through taxation, liability protection, and simpler tax processes, making them attractive for small businesses. However, they come with increased personal tax liability, limited growth potential, and compliance risks across jurisdictions. These entities enjoy straightforward administration but lack formality for asset protection, posing legal complexities in operations.

How Is a Disregarded Entity Different From a Limited Liability Company (LLC)?

A disregarded entity is a single-member LLC that is not separately taxed from its owner, meaning its profits and losses as a separate entity are reported on the owner’s tax return for the IRS. However, a general LLC can have multiple members and may choose to be taxed as a corporation, thus differing in its organizational and tax treatment.