How to File an Annual Report in Florida: A Step-by-Step Guide

As your business expands, compliance becomes increasingly important. With larger teams and multiple locations, there are more rules and regulations to follow and a greater potential for things to go wrong.

Failure to comply with state-mandated filing requirements can have serious consequences for any business. These consequences range from financial penalties to reputational damage to even criminal charges. Meeting these requirements is essential to maintaining good standing and ensuring the smooth operation of your business.

Wondering how to file an annual report in Florida? This guide provides clear, actionable steps, from gathering the required documentation to submitting the filing online. We’ll highlight key deadlines, common pitfalls, and the penalties for late or missed filings.

Main Takeaways From This Article:

- Filing an annual report in Florida requires specific information such as the entity name, Federal Employer Identification Number, and registered agent details.

- Various business entities, including corporations and limited liability companies, are required to submit annual reports to maintain compliance.

- Understanding the step-by-step process of accessing Florida’s online filing portal ensures timely and efficient report submission.

- Knowing filing deadlines and potential penalties is crucial for avoiding unnecessary costs and maintaining good standing with the state.

- Filejet offers automated solutions to streamline the annual report filing, making it easier for businesses handling multiple entities.

What Is an Annual Report?

An annual report is a compliance document that businesses must file with the state to maintain their legal status and good reputation. Unlike a financial statement, which provides a detailed overview of a company’s financial performance, an annual report serves to update the state with current information about the business entity. This information helps ensure the accuracy of government records and allows the state to maintain a current and reliable database of businesses operating in its jurisdiction.

Who Is Required to File an Annual Report in Florida?

An annual report is not a financial statement but a compliance document mandated by the state to maintain your business entity’s good standing. It is typically required for the following business entities operating in Florida:

Corporations (C-Corps and S-Corps)

All corporations, whether closely held by a few shareholders or publicly traded, are obligated to file annual reports. This requirement ensures that the state maintains accurate records of corporate officers and directors, which is crucial for various legal and administrative purposes.

Limited Liability Companies (LLCs)

Florida requires all LLCs to file an annual report with the Department of State. This mandatory filing updates the state’s records with current information about the LLC, including member names and addresses, registered agent details, and the business address. Timely filing is crucial for maintaining good standing and avoiding potential penalties, such as fines and administrative actions.

Limited Partnerships (LPs)

LPs in Florida are also required to file an annual report with the Florida Division of Corporations. This filing ensures that the state’s records accurately reflect the LP’s current information, including the names and addresses of general and limited partners, the registered agent, and the principal office address.

Limited Liability Partnerships (LLPs)

LLPs in Florida must file an annual report with the Florida Department of State. This filing helps maintain the LLP’s legal status and compliance with state regulations. The annual report typically includes information such as the names and addresses of the partners, the registered agent, and the principal office address.

Foreign Entities Operating in Florida

Even foreign entities operating in Florida must submit annual reports as a condition of maintaining their business registration with the state. This reporting requirement is a matter of compliance with state regulations. Filing ensures that these foreign businesses operate under the legal framework of the state.

The purpose of these reports is the same as for other entities: to update the state’s records with the entities’ complete current information, which includes the location of their registered agent and principal office address. This allows the state to communicate effectively with these businesses and ensure it can properly oversee all companies operating within its jurisdiction.

If foreign entities operating in Florida do not comply with annual report filing requirements, they risk losing access to the market, reputational damage, and run-ins with the law. To avoid these consequences and maintain smooth operations in the state, prioritizing timely and accurate filings is key.

Preparing to File an Annual Report: What You Need

Before beginning the annual report filing process, businesses must gather all necessary information. This process can be complex, particularly for middle-market companies, given their large-scale operations spread across regions, so thorough preparation is key.

Entity Name and Registration Number

This information acts as your business’s unique identifier in the state’s records. It typically includes your entity’s full legal name, such as “ABC Corporation” or “XYZ LLC,” and a unique registration number assigned by the state during the initial formation process.

Federal Employer Identification Number (FEIN)

The FEIN, issued by the Internal Revenue Service (IRS), is a nine-digit number that serves as your business’s unique tax identification number. It is essential for various tax-related purposes, including filing federal taxes, opening business bank accounts, and conducting certain business transactions.

Principal Office Address and Mailing Address

The principal office address is where a business primarily operates, while the mailing address is where it receives official correspondence. It’s important to keep both addresses accurate and up-to-date to ensure proper communication and record-keeping with the state.

Names and Addresses of Officers, Directors, or Managing Members

It is crucial to ensure an accurate representation of the company’s leadership in the Florida annual report. Gather the current names, titles, and complete addresses of all officers, directors, or managing members.

Accuracy and transparency in this data are paramount because they reflect the governance structure and oversight of an organization. Ensure that each individual’s name and address are up to date, as these details are publicly accessible and integral for legal purposes.

Registered Agent Information

The registered agent is the appointed individual or entity tasked with receiving official communications on behalf of your business. This includes legal documents, tax notices, and other important communications from the state.

The registered agent must have a physical street address within the state. Ensuring this information is current is critical to avoid delays or missed communications that could have significant legal and financial consequences.

How to File a Florida Annual Report: Six Steps to Success

Filing an annual report in Florida may seem straightforward, but for middle-market companies with multiple entities and complex organizational structures, it can be challenging. These businesses often have to manage complex compliance demands. Streamlining these filings is paramount to avoid costly delays and ensure uninterrupted operations. Here are six steps to nail the process:

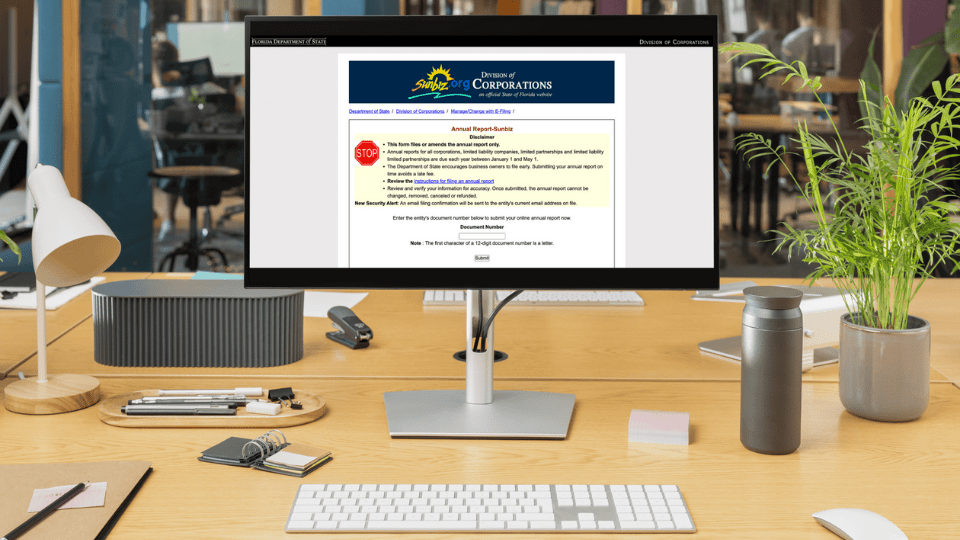

1. Access the Filing Portal

The most convenient and efficient way to file an annual report in Florida is through the online portal provided by the Florida Department of State (DOS).

- Access the SunBiz Portal: Visit the official SunBiz portal at https://dos.fl.gov/sunbiz. This portal serves as the primary interface for interacting with the DOS for various business-related services, including annual report filings.

- Locate and Navigate to the Filing Page: Click the ‘Annual Report Filing’ option in the SunBiz portal to navigate to the specific page for initiating an annual report filing.

2. Login or Retrieve Filing Details

If your company already has a SunBiz account, log in using your registered username and password. If you do not have an existing account, you will need to create one to access the filing system. This usually involves providing basic information about your business entity.

Once logged in, the system should automatically retrieve information about your business entity, such as the entity name and registration number. This can significantly expedite the filing process.

3. Fill Out the Online Form

The online form will guide you through the necessary information fields. For middle-market companies, it’s crucial to ensure the data entered is accurate and up-to-date across all entities.

- Entity Information: Verify and update information such as the entity name, registration number, and entity type.

- Contact Information: Enter the current principal office address, mailing address, and contact person details for the business.

- Registered Agent Information: Update the information for your registered agent, including their name, address, and contact information.

- Officer/Director/Member Information: Provide accurate and current information for all officers, directors, or managing members, as applicable to your business entity type.

- Jurisdictional Information: Indicate the county where your business conducts its primary activities.

4. Review and Verify the Information

Before submitting the filing, thoroughly review all the information. Cross-reference the information entered on the form with your internal records to ensure that all details are accurate and consistent with your records.

Carefully proofread all entered data for any typos and spelling errors. For middle-market companies, implementing a dual-review system is highly recommended. Designate a specific individual or team in the company to independently review the completed filing before submission. This internal review acts as a crucial safeguard, minimizing the risk of errors and inconsistencies that could hold up the process.

5. Pay the Filing Fees

Florida typically charges a fee for processing annual report filings. The online portal offers convenient payment options, such as credit card or electronic funds transfer.

Ensure that the correct fee is calculated and paid to avoid delays in processing. The fee to file an annual report in Florida depends on the type of business entity:

- Profit Corporation: $150

- Non-Profit Corporation: $61.25

- LLC: $138.75

- LP: $550

Although these fees are set by the Florida Department of State, they are subject to change. You should always verify the current fee amount before filing.

6. Submit and Retain Confirmation

Once you have reviewed and verified all information and paid the applicable fees, submit your annual report electronically. Upon successful submission, the system will typically generate a confirmation number or receipt.

Retain a copy of this confirmation for your records. This documentation will be crucial for future reference and in case of any inquiries or disputes.

Streamline Your Compliance Processes With Filejet

For middle-market businesses, managing compliance can be a complex and time-consuming process. Scaling your compliance processes with tools like Filejet ensures that your annual report filings are accurate, timely, and hassle-free, as automation helps you allocate resources efficiently, minimize the risk of errors, and free up time for strategic business growth.

Our software is designed to help businesses track filing deadlines, manage compliance across different entities, and ensure timely filings. This reduces the administrative burden and improves efficiency for companies handling multiple entities, freeing up valuable time for other critical business activities.

Experience firsthand how Filejet can transform your filing strategy. Book a demo today to see our automated and scalable solutions in action.

FAQs

What Is the Deadline for Florida Annual Report Filing?

The deadline for filing an annual report in Florida varies depending on the entity type. For the most up-to-date information, refer to the official Florida Department of State website or consult with a legal or compliance professional. However, if you do not file your annual report by the third Friday of September, your business entity will be administratively dissolved or revoked in the records at the close of business on the fourth Friday of September.

How Much Does It Cost to File an Annual Report in Florida?

The filing fees vary based on the business type:

- Profit Corporations: $150

- Non-Profit Corporations: $61.25

- LLCs: $138.75

- LPs: $550

A non-negotiable late fee of $400 applies to any filings submitted after the deadline.

Can You Submit a Florida Annual Report Online?

Yes, the Florida Department of State encourages online filing of annual reports through its SunBiz portal. Online filing is generally the most efficient and convenient method, as it allows for faster processing, reduces paperwork, and minimizes the risk of errors.